Some Known Details About Joseph Hoell Insurance

Little Known Questions About Joseph Hoell Insurance.

Table of ContentsThe 2-Minute Rule for Joseph Hoell InsuranceJoseph Hoell Insurance for DummiesFacts About Joseph Hoell Insurance UncoveredHow Joseph Hoell Insurance can Save You Time, Stress, and Money.The Best Guide To Joseph Hoell Insurance6 Simple Techniques For Joseph Hoell InsuranceJoseph Hoell Insurance - The Facts

In scenarios where 2 bonds are called for, professionals can obtain an efficiency bond (covers efficiency) and a repayment bond (covers repayment of labor and product). This determines the quantity payable by each insurer when the guaranteed person is covered under 2 or even more team health insurance plan (Independent Insurance Agency in Wisconsin). Complete compensation must not exceed 100% of the cost of careIt usually is a tiny quantity, such as $5 or $10 per workplace go to. Life or special needs insurance to cover a vital staff member whose fatality or disability would create the company financial loss. The plan is had by and payable to the company. When the consumer needs to pay out-of-pocket to obtain health treatment.

Joseph Hoell Insurance - An Overview

The scope of defense given to the insured person under an insurance policy contract. A process medical insurance companies utilize to examine and verify the medical credentials of health care suppliers who intend to take part in a Preferred Service Provider Organization (PPO) or Health Care Organization (HMO) network. An insurance coverage policy that pays financial obligations ought to the borrower shed their task, pass away, or come to be handicapped (usually called "credit history life" plan).

These are five-digit codes established by the American Medical Association that medical professionals utilize to connect with health insurance plan concerning the tasks and solutions they supplied to a person. Medicare describes these as Medical Care Common Procedure Coding System (or HCPCS) codes. The section of an insurance coverage which contains details concerning threat.

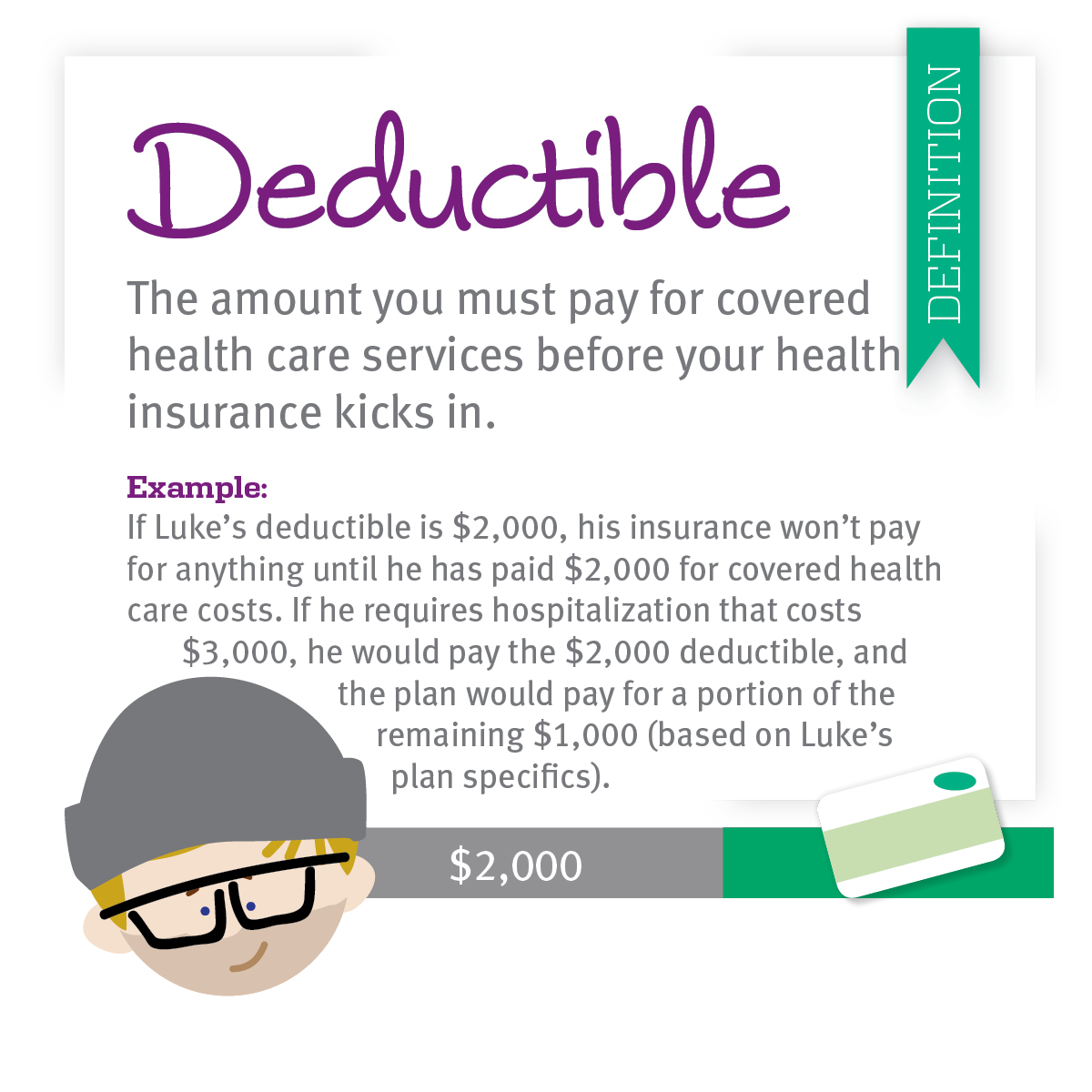

A term life insurance policy that gives a survivor benefit which decreases over the term of insurance coverage - Wisconsin Insurance Agency. Frequently marketed together with a home mortgage and might be referred to as a Mortgage Protection plan. The buck amount a guaranteed individual has to spend for protected charges during a fiscal year before the plan starts paying cases

Getting The Joseph Hoell Insurance To Work

An annuity in which the advantages start at some marked future date. This is home not had, operated, or regulated by the company owner; nonetheless, he or she depends upon it for normal business operations. Reliant home secures the service proprietor from economic losses triggered by troubles that occur in other places, such as with one more supplier or distributor that endures a loss.

The part of an insurance policy costs that relates to the run out part of the plan term. Despite the fact that clients pay their premiums in development, the insurance company does not completely make the premium until their consumers' plan term expires. Insurance business provide earthquake protection as additional coverage to home owner plans, and basic commercial building and casualty policies.

Whether a person qualifies for insurance coverage or not. If you were qualified, and after that shed eligibility, health and wellness plans might terminate your coverage and deny any cases sustained after eligibility was lost.

More About Joseph Hoell Insurance

This is a statement your medical insurance company sends you after you obtain medical services. It reveals what the clinical company charged for the browse through and services, what your insurance provider enabled and paid, and what you may owe out-of-pocket. The opportunity of loss. Review of strategy or provider's rejection of protection or solutions by an Independent Review Organization (IRO).

Some Ideas on Joseph Hoell Insurance You Need To Know

The plan fiduciary must safeguard strategy assets and carry out insurance claims for the exclusive objective of giving benefits to plan participants. A damaging advantage determination that has actually been supported by a health insurance at the conclusion of the internal appeals process. If a consumer desires to appeal a final adverse benefit resolution, he or she would certainly request an external evaluation from their health and wellness plan.

6 Easy Facts About Joseph Hoell Insurance Explained

It is not consisted of in ordinary homeowner and business plans. Flood insurance policy, which also covers damage created by landslides, is available with the National Flood Insurance Policy Program (NFIP) at 800-427-4661.

This business-related protection applies to losses that occur because of problems with supplying or obtaining products that international suppliers manufacture. A released checklist of prescription medications a healthcare plan covers. An insurer arranged under an unique area of the state insurance coverage code, characterized by a lodge or social system such as an Elks or Moose Lodge.

The smart Trick of Joseph Hoell Insurance That Nobody is Discussing

The insurance firm pays the problems, and handles business' legal defense and pays for it. Property insurance covers an organization' physical assets such as structures, equipment, home furnishings, fixtures, stock, and so on. Commercial insurance coverage plans may or anchor may not include glass damage. If they do not include glass coverage you might have the option to acquire unique glass-breakage coverage for procedures that present a special danger - Home Insurance Wisconsin.